In any relationship-led business, the need to converse and share information with customers is important. The in-person interaction experience has evolved significantly over the last decade, with increased video chat adoption, screen-sharing and co-browsing applications becoming normalised. But what about the sharing of documentation? Critical to almost every regulatory compliance process and legal transaction, has the process and experience of sharing documentation between bank and customer really evolved?

Contacting clients to collect up to date information is a necessary part of any regulated business’ day to day responsibility. It also makes practical commercial sense, ensuring that you always know your customer and always offer them the most appropriate products and services along the way.

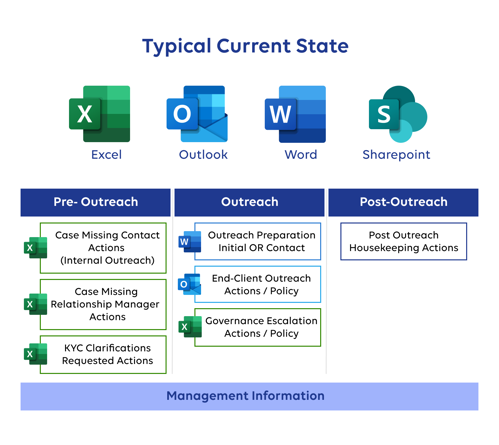

But for as much as it is required and makes good business sense, most firms and clients agree that the whole process can be cumbersome and frustrating. So much so that, in the case of B2B clients, most banks will try to minimise the volume of outreach by sourcing information in the public domain.

Collecting up to date information from clients is a regulatory requirement in every major financial market around the world. It’s not optional. But the client experience is marred with challenges. There are typically three reasons to conduct outreach with clients:

Common challenges associated with outreach processes include:

Various solutions in the market seem to attempt to tackle different aspects of these challenges without ever really tackling all of them perfectly. Some focus on trying to generate a holistic list of requirements for the client, without necessarily trying to orchestrate the collection. Some try to focus on making the collection experience as secure as possible, by using authenticated portals for example. There are a few different types of technology-based solutions in the market:

| Solution | Business Process | Client Experience | Operational Risk | Security and Data Privacy |

| CLM Platforms |

|

|

|

|

| Email Orchestration Platforms |

|

|

|

|

| Portals |

|

|

|

|

| Co-browsing / VOIP platforms |

|

|

|

|

From the table we can see that no one solution type really addresses all the challenges faced in mass-outreach campaigns completely.

CLM platforms can address the consolidation of disparate business processes into a single outreach requirement, if implemented properly. Email orchestration platforms can automate and enhance the process of conducting outreach for the Bank, whilst not interrupting the client experience and forcing them to log into something new. Neither do much for improving security and data privacy by themselves.

Portals are highly secure ways to share data, as are co-browsing and VOIP platforms. Both can be fed by CLM platforms generating the requirements that clients need to complete or provide. Portals are generally disliked by clients, unless they are part of an existing transactional banking service like Online Banking, because they require remembering login details. This is particularly an issue in B2B relationships, where the company secretary or compliance officer responsible for submitting information to the company’s bank may change from time to time. Co-browsing platforms can be highly effective in high-touch relationship-led client interactions, but don’t scale so well in higher-volume light-touch environments.

Whilst it might also seem obvious that a hybrid approach would cover all bases, that can be both impractical and expensive to implement and maintain. It involves buying, integrating and managing multiple tools and training staff to utilise them effectively.

We have developed our own Client Outreach solution that enables the orchestration of client outreach campaigns in a secure, auditable, and low-friction manner. Client Outreach has been developed to assist firms in contacting clients and monitoring those contacts and subsequent interactions.

The Client Outreach product is designed to fit seamlessly into your existing business processes and enable fast, efficient client outreach campaigns at scale and with complete oversight.

The product is designed to support any business that needs to contact clients at scale, with a focus predominantly on regulated use cases in financial services. Your clients don’t need to do anything different – they receive and respond to emails as they do today.

Using the Client Outreach product will drive:

Client Outreach can consume requirements from upstream CLM Platforms and contact information from CRM systems. It connects directly to the Bank's own email server, ensuring that clients continue to receive communications from the Bank rather than a third party. This also ensures that the Bank's already-in-place communication surveillance tools and processes continue to operate as normal without needing to do anything new.

Upcoming developments also include a unique take on the portal concept, removing the need for remembering infrequently used login credentials. We are also exploring the use of state-of-the-art co-browsing capability for white-glove relationship-based interactions that would remove the need for wet signature processes and enhance client experience by sharing evidence and documentation virtually.

Coupled with FinTrU’s flexible and highly skilled services capability, whereby we can help augment in-house outreach teams through staff augmentation and outsourcing models, our total package helps our clients deliver outstanding customer service with efficiency and professionalism.

Written by:

Steven Hewlett-Light is FinTrU's Head of Product, responsible for the vision and strategy behind the technology products we develop for our clients. Steven has over 20 years' experience in financial services, working across a wide range of financial services verticals. Steven has extensive experience creating software solutions that solve complex regulatory challenges, including the use of Artificial Intelligence and Machine Learning, and working with clients to ensure those solutions meet their individual needs and requirements.