Corruption and related infringements might occur within a wide range of situations, with consequences that bear a detrimental effect on economic development, political systems, justice, and public confidence in the functioning of society.

Alongside guidelines and recommendations on preventing and fighting corruption issued by international organisations such as the United Nations, the OECD or Transparency International, there are other applicable legal regulations, such as the UK’s Bribery Act.

In Portugal, following the publication of Decree-Law 109-E/2021, which creates the National Anti-Corruption Mechanism (“MENAC”) and approves the General Regime for the Prevention of Corruption (“RGPC”), corruption risks and related infringements prevention now has a specific legal framework within the Portuguese legal system.

FinTrU Limited (“FinTrU”) is an organisation that adheres to strict rules concerning conduct ethics in all its global locations. We are committed to identifying, preventing, and controlling all corruption and related risks. This commitment extends to all FinTrU employees, interns, contractors, suppliers and third parties with whom FinTrU engage in all the global locations in which it operates.

FinTrU is a multi-award-winning company providing regulatory technology and service solutions for our clients, primarily Tier 1 investment banks. It has a zero-tolerance approach to any signs of corruption or bribery as laid out in its Code of Ethics and Conduct and internal policies. FinTrU is guided by principles of transparency, integrity, honesty, and accuracy and has a risk framework that ensures that rules of professional conduct are observed by all our staff and stakeholders.

This document describes FinTrU’s Risk Prevention Plan (“RPP” or “Plan”), which identifies the risks of corruption and related infringements connected with each department/area of activity, and the measures to prevent/mitigate their occurrence, procedures for updating, monitoring and defining those responsible for supervision. The RPP covers the entire organisation and activities of FinTrU Limited, and compliance is mandatory.

The purpose of this Plan is to implement FinTrU’s commitment to proactively fight and prevent all forms of corruption, by defining principles and guidelines for preventing these practices. The RPP further develops and embodies the principles and rules of conduct established by FinTrU, in its Code of Ethics and Conduct, its Policies and its Compliance Framework which are internal regulations that bind all employees regardless of their function, relationship or place of work. The RPP applies to all employees of FinTrU Group, regardless of their employment relationship. This Plan also applies to the various stakeholders who are directly or indirectly involved in the activities of FinTrU.

1.1 Definitions

Corruption is understood as the abuse of a power or function to benefit a third party, against the payment of a sum or other type of advantage.

The crime of corruption always implies the combination of four elements:

The following are considered acts of corruption:

A bribe is the offer, promise, gift, acceptance, or request of an advantage as an inducement for an action that is illegal, ethically incorrect or a breach of trust. These types of incentives can take the form of gifts, loans, fees, rewards, or other benefits.

Trading in influence is the behaviour of anyone who, by him or herself or through an intermediary, with his or her consent or ratification, solicits or accepts, for him or herself or for a third party, a pecuniary or nonpecuniary advantage, or the promise thereof, in order to abuse his/her influence, be it real or alleged, with any public entity.

Facilitation payment refers to a payment or any other compensation promised or offered to a public official, intended to secure the performance, or hasten a course of action which that public official had a legal duty to perform.

FinTrU defines improper conduct as that which, in addition to others, incorporates the following behaviours:

The criminal sanctions associated with acts of corruption and related offences are, in addition to those provided for in the Portuguese Penal Code, namely for the crimes of:

3. FinTrU Risk Framework (Risk Prevention Plan)

3.1 Introduction

This Plan adheres to the terms set forth by the MENAC legislation and the resulting article 3 of the GRPC – Corruption and Related Offences. It encompasses the entire organisation and all activities of FinTrU, including management, administration, commercial, operations and support functions.

Whilst the Risk Framework looks at all risks FinTrU may be susceptible too, it also identifies, analyses, and classifies the risks and situations that could expose FinTrU to acts of corruption and related offenses. It covers risks associated with executive and managerial responsibilities, considering both the sector and the geographical areas in which we operate.

Moreover, it includes preventive and corrective measures designed to reduce the likelihood of these risks occurring, as well as mitigating the impact should they occur.

3.2 Responsibility for the Execution, Control and Revision of the Plan

FinTrU has appointed Roland Shaw to the position of Regulatory Compliance Officer. The Regulatory Compliance Officer has overall responsibility for the execution, control, and review of this plan. The Regulatory Compliance Officer is Head of the Risk and Compliance Team with a dedicated Compliance Manager and Risk Manager supporting the position of Regulatory Compliance Officer and the maintenance and implementation of this Plan. The Regulatory Compliance Officer is responsible for the oversight of the company risk and compliance framework including oversight and maintenance of relevant policies, training and awareness, data privacy and internal controls.

The monitoring of this Plan is ensured through documentation, periodic review of controls and the implementation and recording of evidence of their execution. The monitoring is accompanied by reports on the implementation and development of relevant initiatives as well as the consolidation and internal reporting of information on the Plan’s implementation progress. It particularly covers the analysis of risks, the implementation of controls, reporting of situations of noncompliance that have occurred, the results of assessments and audits of the Plan implementation carried out by the Risk and Internal Controls and Compliance department.

Furthermore, the Regulatory Compliance Officer ensures the dissemination of the RPP to all employees by way of initial reporting to ExCo and uploading the plan onto the FinTrU intranet and external internet pages.

3.3 Identifying, Analysing and Classifying Risks

3.3.1 Introduction

Within the scope of its risk management and internal control systems, FinTrU has a set of mechanisms and procedures aimed at preventing, detecting and/or mitigating the possible effects of the risks to which it is exposed. The Plan for the Prevention of Corruption Risks and Related Infractions is part of the Risk Framework within FinTrU which includes among others the risks of bribery and corruption.

The Risk Framework embodies the following main activities.

3.3.2 Risk Identification and Assessment

FinTrU’s Risk Prevention Plan seeks to ensure that all risks related to bribery and corruption faced by FinTrU are effectively identified, assessed, mitigated and monitored. The goal is to safeguard FinTrU’s assets, reputation, and strategic objectives by implementing a structured risk management process. It applies to all employees including contractors and interns, departments, and operations in all jurisdictions across FinTrU. It includes all strategic, operational, financial, legal, regulatory, and environmental risks that may affect the company.

All employees, contractors, and interns throughout FinTrU need to have an appropriate level of awareness of the requirements of FinTrU’s Risk Framework as it relates to their role and supports its adoption and integration into the way risk is managed.

Risks are identified and assessed in the following manner.

Risk Identification and Assessment:

Manage and Mitigate

Monitor

Report

The risks considered within FinTrU’s Risk Taxonomy which have been identified relating to corruption and related offences are detailed below:

(See Appendix 1 for classification of these risks)

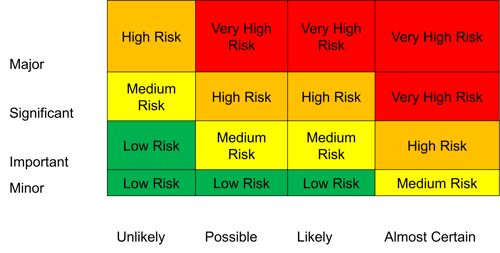

Probability and Impact Tables

During facilitated risk assessments FinTrU measure the potential exposure of the risks that have been identified and the likelihood of them occurring within the next 12 months. Impacts must be assessed against four impact sections: Client, Regulatory, Reputational and Financial with Major, Significant, Important and Minor being the impact categories.

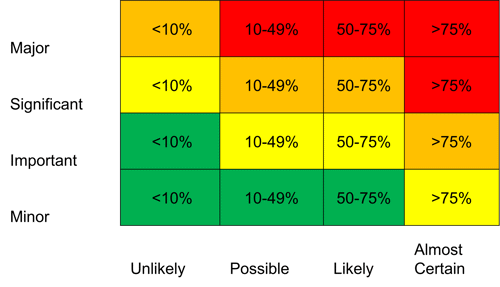

Likelihood is an expression of the possibility of the risk occurring in the next 12 months, with each risk being assigned to one of four quantitative probability categories: Unlikely, Possible, Likely, or Almost Certain.

Unlikely - <10% - Would require highly unusual circumstances for the risk to occur at the impact assessed within the next 12 months.

Possible – 10-49% - There are circumstances where the risk could occur at the impact assessed within the next 12 months.

Likely – 50-75% - Circumstances where the risk could occur at the impact assessed within the next 12 months can be readily envisaged.

Almost Certain - >75% - It seems very likely that the risk will occur at the impact assessed within the next 12 months.

FinTrU’s Risk Appetite statement for Anti Bribery and Corruption Risk is as follows:

FinTrU maintains a Low-risk appetite for Anti-Bribery and Corruption (ABC) Risk, prioritising adherence to all relevant laws and regulations to safeguard our reputation and operational integrity. We have Zero tolerance for bribery and corruption that could result in significant legal penalties or reputational damage, aiming for 100% compliance with all anti-bribery and corruption requirements. Low tolerance is set for moderate ABC issues, with a target of resolving 95% of such incidents within 24 hours. Medium tolerance applies to minor ABC challenges, ensuring that 90% of identified issues are addressed within one week. This structured approach ensures we uphold the highest standards of ethical business practices, fostering trust and reliability.

If any risk relating to Anti Bribery and Corruption falls outside of FinTrU’s Risk Appetite, immediate corrective measure will be taken.

Preventative and Corrective Measures

FinTrU undertakes to implement the Risk Prevention Plan through the adoption of preventative and correctives measures according to the level of risk of the various situations with the aim of preventing or eliminating their possible occurrence. In the event of high-risk situations (Major and Almost Certain) more exhaustive preventative measure are put in place and given a priority status. See Appendix 1 for further details.

4. Mitigating Factors and Compliance with RPP

Code of Conduct

FinTrU’s Code of Conduct sets forth the core principles applicable to FinTrU activities in all jurisdictions. The Code of Conduct is applicable to all employees in FinTrU.

Whistleblowing Channel

FinTrU’s Whistleblowing Policy outlines the guidance for all staff. This independent reporting service provides a medium for all current and former employees and third parties to report, anonymously if they wish, any concerns about FinTrU or the way we do business.

Training Programme

FinTrU has an extensive mandatory compliance training programme throughout the time an employee is with the company. FinTrU has recently collaborated with a new training provider who will be providing bespoke anti-bribery and corruption and related regulatory-based training. Training will include risk management as it relates to anti-bribery and corruption and related offenses, FinTrU’s Code Conduct and the operation of the FinTrU Whistleblowing Policy, including rights associated with whistleblowing protection.

Mandatory training will also be provided for the following areas:

This essential training is a crucial component of our commitment to maintaining the highest standards of ethical behaviour and regulatory adherence within our organisation. Completion of training is mandatory for all employees, which ensures that everybody is equipped with the knowledge and tools necessary to uphold our shared values and legal responsibilities. Furthermore, at employee induction every member of staff is provided with training relating to Anti-Bribery and Corruption.

Responsibility for ensuring the delivery and completion of training rests with the Risk & Compliance Manager, reporting directly to the Regulatory Compliance Officer.

At FinTrU, employees who fail to comply with the RPP and FinTrU’s internal Anti-Bribery and Corruption (ABC) policies and Compliance Programmes may face a range of disciplinary measures and sanctions. These can include verbal or written warnings, suspension, demotion, or even termination, depending on the severity of the non-compliance. Additionally, FinTrU may conduct internal investigations and, if necessary, report the misconduct to relevant authorities. The company emphasizes a culture of integrity and transparency, ensuring that all employees are aware of the consequences of violating the ABC policy.

6. Monitoring of the Risk Prevention Plan

The prevention of corruption risks and related infringements applies to all FinTrU’s employees in the exercise of their duties and powers, in accordance with the established internal rules and policies. It is the responsibility of everyone in charge of each FinTrU business area to ensure that their teams are aware of the RPP and act in strict compliance with it. To this end, FinTrU provides all employees with training on the prevention of corruption and related infringements.

The Compliance Department monitors the implementation of this Plan. FinTrU’s Risk Manager and Compliance Manager assume the responsibility for implementing, monitoring, and reviewing this Plan. The monitoring of this Plan is ensured through documentation, periodic review of controls, and the implementation and recording of evidence of their execution.

It particularly covers the analysis of relevant risks; the implementation of controls; reporting of situations of noncompliance that have occurred; the results of assessments and audits of the Plan implementation carried out by the Risk and Internal Control Department or by an external entity.

FinTrU’s General Counsel and Regulatory Compliance Officer presents to the Executive Committee of FinTrU on the assessment and implementation of the Plan in relation to the previous year.

This RPP is reviewed every year, whenever there is a change in FinTrU’s duties or corporate structure, or when there are applicable legislative changes.

APPENDIX 1 – ABC Risk Assessment Results

|

Risk Name |

Likelihood |

Impact |

|

Vendor / Third Party Management Risk |

Likely |

Important |

|

Specific ABC Causes of Identified Risk |

||

|

· Illegitimate favouring of certain suppliers or service providers · Conflict of Interests · Offers and Events · Fictitious contracts/invoices · Irregular Payments · Relationships in sanctions countries |

||

|

Mitigating Factors |

||

|

· Compliance to the following Policies: · Compliance with Third Party Management Processes · Financial controls on payments |

||

|

Legal type of crimes |

||

|

· Corruption – articles 372 to 374-A of the Penal Code · Undue receipt or offer of advantage – article 372, n.º 1 of the Penal Code · Influence Peddling – article 335 of the Penal Code |

||

|

Risk Name |

Likelihood |

Impact |

|

Regulatory Compliance Risk |

Possible |

Minor |

|

Specific ABC Causes of Identified Risk |

||

|

· Granting gifts or hospitality to obtain illegitimate advantages · Facilitation payments · Corruption |

||

|

Mitigating Factors |

||

|

· Compliance to the following Policies: · Attestation to completion of monthly Compliance Training · Attestation to review of company policies · Periodic reviews of the effectiveness of Compliance Training · Periodically adapt awareness raising measures · Ensure awareness of External Whistleblowing partner and monitoring for effectiveness · Information Security Training and Awareness · Horizon scanning of regulatory and legal requirements across all jurisdictions |

||

|

Legal type of crimes |

||

|

· Corruption – articles 372 to 374-A of the Penal Code · Undue receipt or offer of advantage – article 372, n.º 1 of the Penal Code · Influence Peddling – article 335 of the Penal Code |

||

|

Risk Name |

Likelihood |

Impact |

|

Client Contract Risk |

Possible |

Minor |

|

Specific ABC Causes of Identified Risk |

||

|

· Illegitimate favouring of certain suppliers or service providers · Conflict of Interests · Offers and Events · Fictitious contracts/invoices · Irregular Payments · Relationships in sanctions countries · Fraud · Private Corruption · Money Laundering |

||

|

Mitigating Factors |

||

|

· Compliance to the following Policies: · Attestation on completion of Compliance Training · Periodic reviews of the effectiveness of Compliance Training · Compliance to procedure relating to new client contracts and onboarding · Compliance to Competition Regulations |

||

|

Legal type of crimes |

||

|

· Corruption – articles 372 to 374-A of the Penal Code · Undue receipt or offer of advantage – article 372, n.º 1 of the Penal Code · Influence Peddling – article 335 of the Penal Code · Economic participation in business – article 23 of Law 34/87 of July 16 |

||

|

Risk Name |

Likelihood |

Impact |

|

Information and Cybersecurity Risk |

Possible |

Minor |

|

Specific ABC Causes of Identified Risks |

||

|

· Private Corruption · Conflict of interest · Access to business and commercial information · Favouring software and/or hardware suppliers for their own benefit or that of third parties · Acquisition or appropriation of licensed hardware and/or software for their own benefit or that of third parties · Risk of access to restricted information · Weaknesses in information systems · Access to or misuse of restricted information · Tampering with confidential information |

||

|

Mitigating Factors |

||

|

· Compliance to the following Policies: · Attestation on completion of Compliance Training · Periodic reviews of the effectiveness of Compliance Training · Periodically adapt awareness raising measures · Ensure awareness of external Whistleblowing partner and monitoring for effectiveness · Information Security Training and Awareness · Segregation of Duties · Activation of automatic IT system driven controls · Profile reviews · Password Management Tools e.g. Keeper · Compliance to the Risk Policy · Processing of Data within GDPR |

||

|

Legal type of crimes |

||

|

· Corruption – articles 372 to 374-A of the Penal Code · Undue receipt or offer of advantage – article 372, n.º 1 of the Penal Code · Influence Peddling – article 335 of the Penal Code |

||

|

Risk Name |

Likelihood |

Impact |

|

Client Account Management Risk |

Possible |

Minor |

|

Specific ABC Causes of Identified Risks |

||

|

· Illegitimate favouring of certain suppliers or service providers · Conflict of Interests · Offers and Events · Fictitious contracts/invoices · Irregular Payments · Relationships in sanctions countries · Fraud · Private Corruption · Money Laundering |

||

|

Mitigating Factors |

||

|

· Compliance to the following Policies: · Attestation on completion of Compliance Training · Ensure awareness of external Whistleblowing partnership and monitoring for effectiveness · Information Security Training and Awareness · Segregation of Duties · Password Management Tools e.g. Keeper · Compliance to the Risk Policy · Processing of Data within GDPR |

||

|

Legal type of crimes |

||

|

· Corruption – articles 372 to 374-A of the Penal Code · Undue receipt or offer of advantage – article 372, n.º 1 of the Penal Code · Influence Peddling – article 335 of the Penal Code · Economic participation in business – article 23 of Law 34/87 of July 16 |

||

|

Risk Name |

Likelihood |

Impact |

|

Anti Bribery & Corruption Risk |

Possible |

Minor |

|

Mitigating Factors |

||

|

Compliance to the following Policies: Attestation on completion of Compliance Training |

||

|

Legal type of crimes

|

||

|

· Corruption – articles 372 to 374-A of the Penal Code · Embezzlement – article 375, n. 1 of the Penal Code

|

||

|

Risk Name |

Likelihood |

Impact |

|

People and Employee Relations Risk |

Possible |

Minor |

|

Mitigating Factors |

||

|

Compliance to Policies: - Anti-Bribery and Corruption - Anti-Fraud - Outside Business Interests - Employee Personal Trading - Risk Management - Travel and Expenses

|

||

|

Legal type of crimes |

||

|

· Corruption – articles 372 to 374-A of the Penal Code · Undue receipt or offer of advantage – article 372, n.º 1 of the Penal Code · Influence Peddling – article 335 of the Penal Code |

||

APPENDIX 2 – Legal Regulations

|

Legal Type of Crime |

Conduct |

Legal Framework |

|

|

Crimes in the Penal Code (Decree-Law No. 48/95, of March 15)

|

|||

|

Corruption |

Practice or omission of any act, whether lawful or unlawful, in exchange for receiving undue financial or non-financial advantage, for oneself or for a third party. |

Articles 372 to 374-A of the Penal Code |

|

|

Undue receipt or offer of advantage |

When the official, in the exercise of their duties or because of them, by themselves, or through an intermediary, with their consent or ratification, requests or accepts, for themselves or for a third party, a financial or non-financial advantage that is not due to them. |

Article 372, No. 1 of the Penal Code |

|

|

Embezzlement |

When the official illegitimately appropriates for their own benefit or that of another person, money or any movable property, public or private, that has been entrusted to them, is in their possession or is accessible to them by reason of their duties. |

Article 375, No. 1 of the Penal Code |

|

|

Embezzlement of use |

When the official uses or allows another person to use, immovable property, vehicle, or other movable property or animal of appreciable value, public or private, that has been entrusted to them, is in their possession or is accessible to them by reason of their duties. |

Article 376 of the Penal Code |

|

|

Economic participation in business |

When the official who, with the intention of obtaining, for themselves or for a third party, illicit economic participation, harms in a legal transaction the patrimonial interests that, in whole or in part, they are responsible for, by reason of their function, administering, supervising, defending or carrying out. |

Article 377, No. 1 of the Penal Code |

|

|

Extortion |

When the official, in the exercise of their duties or de facto powers arising from them, by themselves or through an intermediary with their consent or ratification, receives, for themselves, for the State or for a third party, by inducing error or taking advantage of the victim's error, a financial advantage that is not due to them, or is greater than what is due, namely contribution, fee, emolument, fine or penalty. |

Article 379 of the Penal Code |

|

|

Abuse of power |

When the official abuses powers or violates duties inherent to their functions, with the intention of obtaining, for themselves or for a third party, an illegitimate benefit or causing harm to another person. |

Article 382 of the Penal Code |

|

|

Influence peddling |

When someone by themselves or through an intermediary, with their consent or ratification, requests or accepts, for themselves or for a third party, a financial or non-financial advantage, or its promise, to abuse their influence, real or supposed, with any public entity. |

Article 335 of the Penal Code |

|

|

Money laundering |

When the official converts, transfers, assists or facilitates any conversion or transfer operation of advantages, obtained by themselves or by a third party, directly or indirectly, for the purpose of concealing their illicit origin, or to prevent the author or participant of these infractions from being criminally prosecuted or subjected to a criminal reaction. |

Article 368-A of the Penal Code |

|

|

Crimes under Law No. 34/87, of July 16 (crimes of responsibility of political office holders)

|

|||

|

Corruption |

When the holder of a political office, by themselves or through an intermediary, with their consent or ratification, requests or accepts, for themselves or for a third party, a financial or non-financial advantage, which is not due to them, as consideration for making a decision contrary to the duties of the office, within the scope of their functions.

|

Article 17 of Law No. 34/87, of July 16 |

|

|

Undue receipt or offer of advantage |

When the holder of a political office, in the exercise of their duties or because of them, by themselves or through an intermediary, with their consent or ratification, requests or accepts, for themselves or for a third party, a financial or non-financial advantage, which is not due to them.

|

Article 16 of Law No. 34/87, of July 16 |

|

|

Embezzlement |

When the holder of a political office, in the exercise of their duties, illegitimately appropriates for their own benefit or that of another person, money or any movable property, public or private, that has been entrusted to them, is in their possession or is accessible to them by reason of their duties.

|

Article 20 of Law No. 34/87, of July 16 |

|

|

Embezzlement of use |

When the holder of a political office uses or allows another person to use, immovable property, vehicle, or other movable property or animal of appreciable value, public or private, that has been entrusted to them, is in their possession or is accessible to them by reason of their duties.

|

Article 21 of Law No. 34/87, of July 16 |

|

|

Embezzlement by error of another |

When the holder of a political office, in the exercise of their duties, but taking advantage of the circumstantial error of another, receives for themselves or for a third party fees, emoluments or other amounts not due or of a value greater than what is due.

|

Article 22 of Law No. 34/87, of July 16 |

|

|

Economic participation in business |

When the holder of a political office who, with the intention of obtaining, for themselves or for a third party, illicit economic participation, harms in a legal transaction the patrimonial interests that, in whole or in part, they are responsible for, by reason of their functions, administering, supervising, defending or carrying out, as well as when the holder of a political office receives a financial advantage for the celebration of an act relating to interests over which, by virtue of their office, they have at that moment the powers of disposition, administration or supervision, even if they do not harm them.

|

Article 23 of Law No. 34/87, of July 16 |

|

|

Abuse of power |

When the holder of a political office abuses powers or violates duties inherent to their functions, with the intention of obtaining, for themselves or for a third party, an illegitimate benefit or causing harm to another person.

|

Article 26 of Law No. 34/87, of July 16 |

|

|

Prevarication |

When the holder of a political office, in the exercise of their duties, intervenes in a process in which they make unlawful decisions with the intention of harming or benefiting someone.

|

Article 11 of Law No. 34/87, of July 16 |

|

|

Breach of secrecy |

When the holder of a political office reveals a secret that they have become aware of or has been entrusted to them by virtue of their duties, with the intention of obtaining an undue benefit for themselves or a third party or to cause harm to a public interest or that of a third party.

|

Article 27 of Law No. 34/87, of July 16 |

|

|

Crimes under Law No. 20/2008, of April 21 (criminal regime of corruption in international trade and the private sector)

|

|||

|

Corruption prejudicial to international trade |

Practice of any act or omission, directly or indirectly, in the sense of giving or promising to an official, national, foreign or of an international organization, or to a holder of political office, national or foreign, or to a third party with knowledge of those, an undue financial or non-financial advantage, with a view to obtaining or retaining a business, contract or other undue advantage in international trade.

|

Article 7 of Law No. 20/2008, of April 21 |

|

|

Corruption in the private sector |

Practice of any act or omission, directly or indirectly, in the sense of requesting or accepting, for themselves or for a third party, an undue advantage or promise of undue financial or non-financial advantage, in exchange for any act or omission that constitutes a violation of their functional duties.

|

Article 8 of Law No. 20/2008, of April 21 |

|

|

Crimes under Decree-Law No. 28/84, of January 20 (anti-economic offenses and against public health)

|

|||

|

Fraud in obtaining a subsidy or grant |

When the official provides to the competent authorities or entities inaccurate or incomplete information about themselves or third parties and relating to facts important for the granting of a subsidy or grant; omit information about important facts; use a supporting document obtained through inaccurate or incomplete information; in order to obtain a subsidy or grant.

|

Article 36 of Decree-Law No. 28/84, of January 20 |

|

|

Fraud in obtaining credit |

|

Article 36 of Decree-Law No. 28/84, of January 20 |

|

APPENDIX 3 – Requirements That May Result in Disciplinary Action if Not Followed, as Stipulated in Article 128, No 1 of the Portuguese Labour Code

1. Respect and treat the employer, hierarchical superiors, colleagues, and individuals who interact with the company, with courtesy and probity;

2. Attend work with assiduity and punctuality;

3. Perform work with zeal and diligence;

4. Diligently participate in professional training actions provided by the employer;

5. Comply with the employer's orders and instructions regarding the execution or discipline of work, as well as occupational safety and health, that are not contrary to their rights or guarantees;

6. Maintain loyalty to the employer, namely by not negotiating on their own or another's behalf in competition with them, nor disclosing information regarding their organization, production methods, or business;

7. Ensure the preservation and proper use of work-related assets entrusted to them by the employer;

8. Promote or execute acts aimed at improving the company's productivity;

9. Cooperate for the improvement of safety and health at work, namely through the workers' representatives elected for this purpose;

10. Comply with the prescriptions on safety and health at work that arise from law or collective labour regulation instrument.

Document Control

|

Document Name |

FinTrU Risk Prevention Plan |

|

Document Owner |

Risk Manager |

|

Review Frequency |

Annual |

|

Version number |

1.0 |

|

Date Approved |

31/03/2025 |

|

Approver |

General Counsel and Regulatory Compliance Officer |