The FCA has warned that firms who ignore the duty or pose the most harm can expect swift action.

FinTrU can collaborate with firms’ as they aim to close any gaps in their implementation plans before the regulatory deadline. As well as transition to ongoing monitoring and assessment of customer outcomes, providing review support and guidance on best practice ahead of both the July 2023 open products deadline, and the July 2024 closed products deadline.

The FCA, in its fair value framework review, published 10th May 2023, has identified 4 key areas for further consideration by firms:

-

Collecting and monitoring of evidence that demonstrates that products and services represent fair value

-

Clear oversight and accountability of remedial actions

-

Ensuring sufficient analysis of distribution of outcomes across groups of consumers, in the target market, beyond broad averages, to demonstrate how each group receives fair value

-

Summarising and presenting fair value assessments to enable decision makers to robustly discuss whether the product or service represents fair value and being clear on limitations in the analysis or evidence.

Implementation

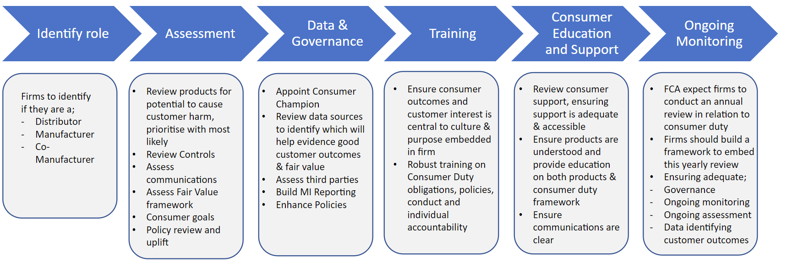

Considering the FCA’s extensive expectations and the looming deadline, firms should have progressed to an advanced stage of understanding their roles, products, data & governance, and consumer support through their implementation reviews or gap analysis.

Firms should be making enhancements to close any gaps in a timely manner before the compliance date. Firms should take careful note that the FCA will prioritise the most serious breaches and act swiftly and assertively where it finds evidence of harm or risk to consumers.

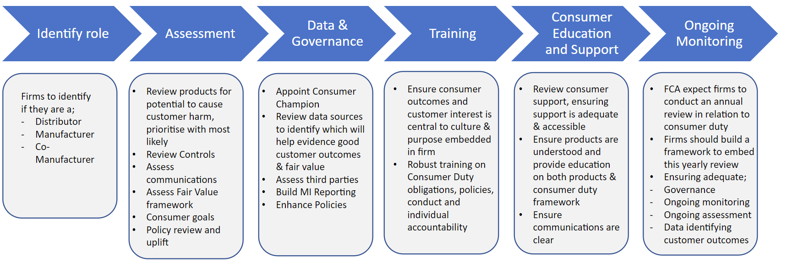

Below we have included a typical Consumer Duty implementation plan and a typical framework for ongoing compliance that FinTrU can support.

Implementation Plan Example

Governance Framework Example

The Importance of the Consumer Duty

Firms should be reminded of the critical importance of the Duty and its aims to enhance the protection of consumers. Unfortunately, consumers have often been subject to financial harm as evidenced by several public financial scandals such as payment protection insurance mis-selling and the London Capital & Finance marketing investigation for mis-selling. It is evident that stringent regulation is essential to prevent similar scandals from reoccurring, and the FCA’s Consumer Duty certainly offers an enhanced level of protection now that firms will be required to monitor, investigate and evidence outcomes. The FCA are expecting firms to utilise data sources for the insights they need to assess their customer outcomes.

If the Duty is correctly applied by firms, it will allow them to get ahead of issues by understanding their root cause and resolving them before they become widespread, and in some instances prevent them from occurring. The shift to understanding consumer needs and outcomes is the positive action required by firms to ensure trust and confidence in their products and services and in the financial services sector generally.

A Reminder – What is the Consumer Duty?

The FCA’s Consumer Duty sets higher and clearer standards of consumer protection across financial services and requires firms to put their customers’ needs first. The Duty introduces a new Consumer Principle, requiring firms “to act to deliver good outcomes for retail customers.”

The duty includes the ‘cross-cutting rules’ which:

-

Develops the FCA’s expectations for behaviour through three overarching requirements.

1. Act in good faith towards retail customers

2. Avoid causing foreseeable harm to retail customers

3. Enable and support retail customers to pursue their financial objectives

-

Inform and help firms interpret the four outcomes

The Four Outcomes

The ‘four outcomes’ are a suite of rules and guidance setting more detailed expectations for firm conduct in areas that represent key elements of firm-consumer relationships:

-

The Governance of products and services

-

Price and value

-

Consumer understanding and

-

Consumer support

The FCA expect firms to carefully consider the requirements set out in its final rules and guidance, identify where they fall short and make changes necessary to their products, communications, systems & processes to meet the duty standard.

Key Dates

July 2022

FCA Final Rules and Guidance Published

October 2022

Firms boards/management bodies should have agreed implementation plans

30th April 2023

FCA deadline for manufacturers to complete necessary reviews and share information with distributors

31st July 2023

Consumer Duty comes into force for new & existing products or services that are open to sale or renewal

31st July 2024

Consumer Duty comes into force for closed products or services

It is more important than ever to deliver good outcomes for retail customers; they need to be confident and trust that the financial services sector will act in their best interests, especially during times of economic instability. Clear communication and the provision of accessible support will build stronger firm-consumer relationships.

The Duty imposes a requirement on firms to understand a wide range of diverse customer needs including vulnerable customers and other distinct customer groups. However, the FCA have been clear that the duty is intended for all consumers.

With the implementation deadlines fast approaching, it is pertinent that firms are progressing with their implementation plans, improving them where required, and are on track to meet the FCA’s expectations under the Duty when it comes into force on 31st July 2023.

How FinTrU Can Help

FinTrU is well positioned with inhouse regulatory compliance expertise and an agile approach that allows for synergies across product types. Learn more about FinTrU's wide-ranging experience in Compliance and the value we can add for global financial institutions.